Financial reporting is a cornerstone of sound business management, providing small business owners with critical insights into their company’s financial health, performance, and prospects. In an increasingly competitive marketplace, effective financial reporting can make all the difference in making informed decisions and charting a path to success. This blog will delve into the realm of financial reporting, expatiating on some of the crucial insights that will help you get a thorough understanding of financial reporting services to seamlessly streamline your financial processes and drive strategic growth. This blog consists of the following sections:

- Understanding Financial Reporting

- Financial Reporting Standards

- The Importance of Financial Reporting for Small Business

- Main Types of Financial Reports

- Key Financial Reporting Principles

- Insightful Tips for Better Financial Reporting

- How We May Help You with Your Financial Reporting Needs

- Conclusion

Understanding Financial Reporting

Financial reporting encompasses the process of preparing and presenting financial statements and reports that communicate a company’s financial performance and position. It involves collecting, analyzing, and summarizing financial data to provide stakeholders with a clear understanding of a business’s financial standing. These stakeholders may include business owners, investors, lenders, employees, and regulatory authorities.

Financial Reporting Standards

To ensure consistency and transparency in financial reporting, standardized frameworks and guidelines have been established. Internationally recognized standards such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) provide a framework for preparing financial reports. Adhering to these standards ensures that financial information is presented accurately, consistently, and in a manner that allows for meaningful analysis and comparison.

The Importance of Financial Reporting for Small Business

Financial reporting plays a vital role in the strategic decision-making process for small businesses and our financial reporting services are exclusively reckoned with due to strict adherence to these key reasons. Some of these reasons include the following:

Informed Decision Making:

Accurate financial reports provide valuable insights into a company’s financial performance, allowing owners to make data-driven decisions. By understanding revenue streams, cost structures, and profitability, business owners can identify areas for improvement, allocate resources effectively, and capitalize on growth opportunities.

External Stakeholder Confidence:

Financial reports instill confidence in external stakeholders such as investors, lenders, and suppliers. Transparent and reliable financial information facilitates trust, making it easier to secure funding, negotiate favorable terms, and build strong relationships with partners.

Compliance and Legal Requirements:

Financial reports ensure compliance with regulatory requirements, tax obligations, and industry-specific guidelines. Timely and accurate reporting helps avoid penalties, audits, and legal complications.

Performance Evaluation:

Financial reports provide a benchmark for evaluating business performance over time. By comparing current results with historical data, owners can assess progress, identify trends, and adjust strategies accordingly.

Key Financial Reporting Principles

Financial reporting is guided by several key principles that ensure consistency and accuracy in the preparation of financial statements. These principles include:

Relevance:

Financial reports should include information that is timely, accurate, and pertinent to users’ needs for decision making.

Reliability:

Information presented in financial reports should be trustworthy, free from bias, and supported by verifiable evidence.

Understandability:

Financial reports should be presented in a clear and concise manner, using language and formats that can be easily understood by stakeholders.

Comparability:

Financial reports should allow for meaningful comparisons, both within the company’s historical data and with industry benchmarks, enabling stakeholders to assess performance accurately.

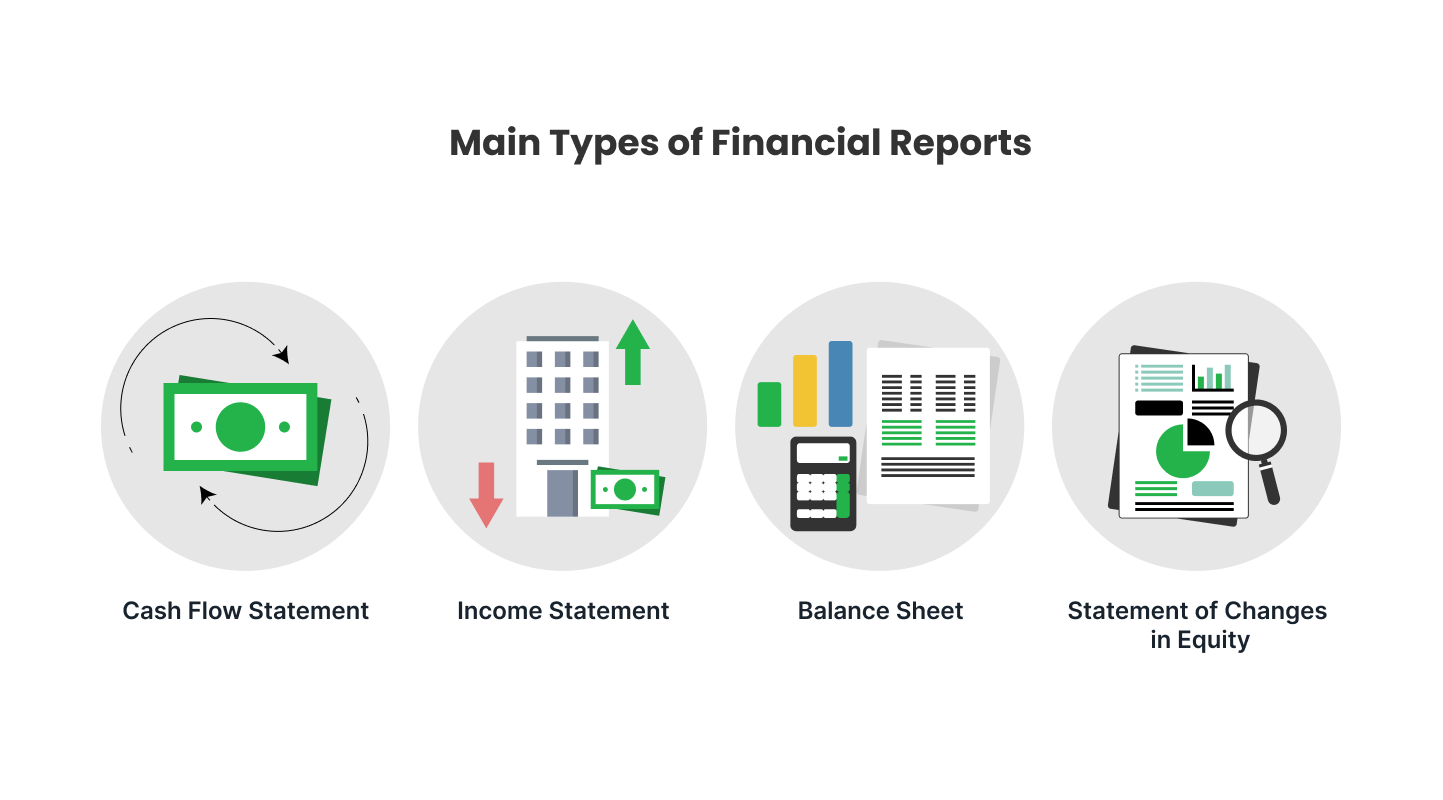

Main Types of Financial Reports

Financial reporting encompasses various types of reports that provide different perspectives on a company’s financial position and performance. Some of the main types are:

Cash Flow Statement:

This report tracks the inflow and outflow of cash within a specified period, providing insights into a company’s liquidity, operating activities, investments, and financing.

Income Statement:

Also known as the profit and loss statement, this report presents a summary of revenue, expenses, and net profit or loss over a specific period. It helps evaluate profitability and assess the efficiency of operations.

Balance Sheet:

The balance sheet provides a snapshot of a company’s financial position at a given point in time, detailing its assets, liabilities, and equity. It reveals the company’s net worth and helps assess solvency and overall financial stability.

Statement of Changes in Equity:

This report tracks the changes in equity during a specific period, including contributions, withdrawals, and retained earnings. It is particularly relevant for companies with multiple owners or shareholders.

Insightful Tips for Better Financial Reporting

To optimize financial reporting for your small business, consider implementing the following tips:

Maintain Accurate Bookkeeping:

Implement robust bookkeeping practices to ensure accurate and up-to-date financial data. Our premium services may help you in this.

Regularly Reconcile Accounts:

Perform periodic reconciliations to verify that your records align with bank statements, identifying any discrepancies or errors.

Embrace Technology:

Utilize accounting software and automation tools, like we do, to streamline your financial reporting processes, reducing manual errors and saving time.

Seek Professional Assistance:

Consider leveraging the expertise of accounting professionals like our highly skilled professionals to ensure accuracy and compliance.

Establish Clear Processes:

Implement clear and documented processes for financial reporting, ensuring consistency and reliability in data collection and analysis.

Train and Educate Staff:

Provide training to your finance team or employees responsible for financial reporting to ensure they understand the importance of accurate and timely reporting.

Analyze Key Performance Indicators (KPIs):

Identify and track relevant KPIs that provide insights into your business’s financial performance, allowing you to monitor progress and make informed decisions.

Regularly Review Reports:

Set a schedule to review financial reports periodically, as we do, enabling you to identify trends, address issues promptly, and align your strategies accordingly.

Engage in Scenario Planning:

Utilize financial reports to conduct scenario analysis, simulating potential outcomes and assessing the financial impact of different decisions.

Seek Professional Advice:

Consult with financial advisors or accountants like the ones in our team to gain insights and guidance on interpreting financial reports and implementing best practices.

Automate Your Financial Reporting with Our Services

At Oak Street Technologies, we understand the challenges small businesses face in managing complex financial reporting processes. We offer a comprehensive suite of services to automate your financial reporting tasks, including bookkeeping, financial reporting, accounts reconciliations, accounts payable, and accounts receivable services. Our experienced team ensures accurate and timely reporting, freeing up your valuable time to focus on strategic growth and core business activities.

Conclusion

To sum it up, financial reporting is a critical aspect of managing a small business, providing valuable insights for decision making, instilling confidence in stakeholders, and ensuring compliance with regulations. By adhering to financial reporting standards, following key principles, and leveraging the various types of financial reports, small business owners can gain a comprehensive view of their company’s financial health and make informed decisions to drive success. By implementing best practices and embracing automation, businesses can streamline their reporting processes, saving time and resources while maximizing accuracy and efficiency.

Trust Oak Street Technologies to be your partner in unlocking the power of financial reporting and driving your business towards a prosperous future.